New figures from an Ilkley-based law firm suggest people are making a will earlier in life than commonly assumed, with the average client instructing the firm to prepare their first will in their mid-40s.

The findings by LCF Law sit alongside long-running national research into will-writing behaviour. According to Remember a Charity’s annual consumer tracker survey, which has tracked attitudes to charitable will writing for 15 years among more than 2,000 UK donors aged 40 and over, the average age people write a will nationally is 50. Together, the data points to a growing trend towards earlier and more proactive estate planning, driven by life events rather than age alone.

LCF Law’s own data indicates that the typical age at which clients first instruct the firm to prepare a will is around 46. Whilst some clients are much younger and others significantly older, the firm believes this reflects a broader shift in awareness, with people recognising the importance of having legal protections in place once they acquire assets or responsibilities.

The law firm, which has offices in Ilkley, Harrogate, Leeds and Bradford, reports that milestones such as buying a property, starting a family, or entering or ending a long-term relationship are the most common triggers for making a will.

Neil Shaw, Head of Personal Law at LCF Law, said:

"There is still a widespread misconception that wills are only relevant later in life. In reality, many people reach a point in their 40s where they have dependants, property or complex family arrangements. At that stage, not having a will can expose loved ones to unnecessary risk should the unexpected happen.”

The national research from Remember a Charity supports the importance of acting early but also highlights a significant risk around outdated wills. Their data shows 61% of charity supporters aged 40 and over have written a will, but half of those have never updated it. Even among people aged over 70, 41% have not reviewed their will since it was first written. LCF Law says this mirrors its own experience. The firm continues to advise older clients who are reviewing or updating existing wills later in life, often prompted by marriage, divorce, bereavement, retirement or changes in financial circumstances. The firm recommends reviewing a will every five to ten years, or sooner following major life changes, to ensure it remains legally effective and aligned with current wishes.

One key issue frequently raised by clients is the position of unmarried couples. Under the rules of intestacy, a partner who is not married or in a civil partnership has no automatic entitlement to inherit, regardless of how long the couple have lived together. As a result, many clients in their 30s and 40s seek legal advice once they realise a will is the only way to ensure a partner is provided for. Parents are also increasingly represented among first-time will writers at the firm.

Neil added:

“A will allows parents to appoint guardians for their children and to specify how and when any inheritance should be accessed. Without a valid will, those decisions may be left to the courts, adding uncertainty and distress at an already difficult time.

“People are often unaware that marriage or entering a civil partnership usually revokes an existing will, or that changes in family relationships can significantly alter how an estate is distributed. Regular reviews are essential to avoid unintended outcomes. We have also seen growing interest in tax efficiency and asset protection among clients in their 40s and 50s, and a professionally drafted will can help manage inheritance tax exposure and reduce the risk of disputes, regardless of the size of an estate.”

In addition to providing legal advice, LCF Law links its will-writing service to a wider commitment to sustainability. Through a partnership with the Yorkshire Dales Millennium Trust, the firm plants a tree for every will it writes or updates, enabling clients to create both a personal and environmental legacy.

Ilkley BID to co-sponsor the 2026 Yorkshire Tots to Teens Awards

Ilkley BID to co-sponsor the 2026 Yorkshire Tots to Teens Awards

International football fixture for Ilkley’s over-60s

International football fixture for Ilkley’s over-60s

Council update on operator of Alpamare water park

Council update on operator of Alpamare water park

Ilkley Real Markets celebrates 10 years trading in the town

Ilkley Real Markets celebrates 10 years trading in the town

New appliance to boost safety and response at Ilkley Fire Station

New appliance to boost safety and response at Ilkley Fire Station

Good Neighbours collaboration to strengthen services amid financial challenges

Good Neighbours collaboration to strengthen services amid financial challenges

Ilkley Moornotes celebrate the wonderful landscape that surrounds us

Ilkley Moornotes celebrate the wonderful landscape that surrounds us

New venue for return of Ilkley Macmillan Fashion Show

New venue for return of Ilkley Macmillan Fashion Show

Spring/Summer line-up at Ilkley Playhouse

Spring/Summer line-up at Ilkley Playhouse

Ilkley Manor House reopens for Spring with a culture-packed programme

Ilkley Manor House reopens for Spring with a culture-packed programme

Ilkley Beer Festival celebrates a successful year of beer, community and charity

Ilkley Beer Festival celebrates a successful year of beer, community and charity

Police appeal following serious collision in Ilkley

Police appeal following serious collision in Ilkley

Beauty in Bloom team all share the same passion

Beauty in Bloom team all share the same passion

Two weeks until 36th Ilkley Moor Fell Race

Two weeks until 36th Ilkley Moor Fell Race

1,000 Smiles: Pateley Bridge woman wins £1,000 prize

1,000 Smiles: Pateley Bridge woman wins £1,000 prize

Children’s books inspires Ilkley Carnival creative competition!

Children’s books inspires Ilkley Carnival creative competition!

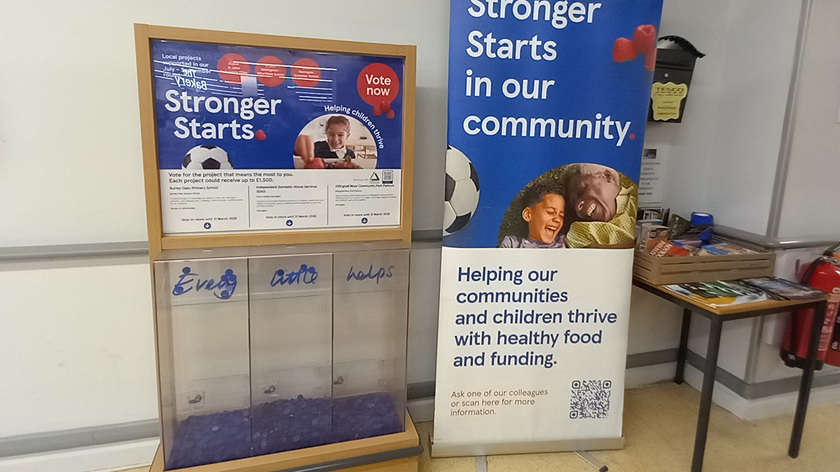

Applications invited for Tesco funding scheme in Ilkley

Applications invited for Tesco funding scheme in Ilkley

Voices needed for Ilkley production of The Prince of Egypt

Voices needed for Ilkley production of The Prince of Egypt

Phase 2 of Ilkley Fountain to enhance focal point

Phase 2 of Ilkley Fountain to enhance focal point

Ilkley man banned from running company appears in court

Ilkley man banned from running company appears in court